|

And ten years hence, you will probably have to shell out Rs 75 for one kilogram of the same quality of rice. This means your power to purchase something for a particular amount reduces going forward.

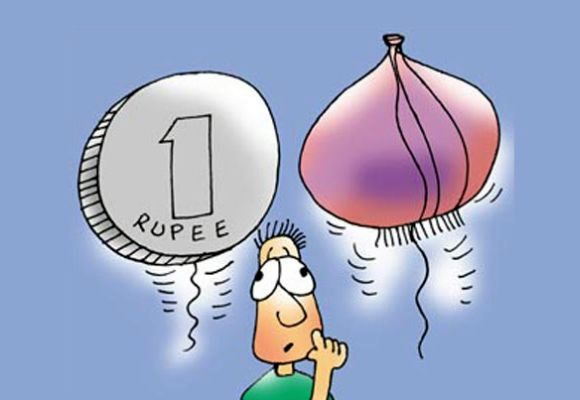

This reduction in your purchasing power is due to the increase in the price level of goods and services. This increase in price levels is termed as inflation.

Now, if your income remains the same over the years, but the price level of goods and services increases, then your purchasing power falls. So, when you talk of income, you must consider your ‘real income’, which is adjusted for the inflation factor.

Remember that inflation always erodes the purchasing power of money. Hence it is very critical to account for inflation when you draw up your financial plan.